The below article was posted by the HBS Alumni Publication about the case study on Bob Reiss’ former company, R&R.

No Trivial Matter

By Garry Emmons

It was 1983, and Bob Reiss (MBA 1956) was looking for a new  game to play. A Brooklyn native and former basketball star at Columbia University who had become a successful entrepreneur in the toy-and-game industry, Reiss was impressed by the feverish public response north of the border to the 1980 Canadian board game, Trivial Pursuit, which was only just then being introduced in America. Reiss realized that other sorts of trivia games could be big sellers, too. With no introduction or insider connections—in what Reiss calls “a six-sentence cold-call letter that led to a $3 million profit venture in eight months”—he proposed a trivia game about television’s shows, history, and personalities to the publisher of TV Guide magazine.

game to play. A Brooklyn native and former basketball star at Columbia University who had become a successful entrepreneur in the toy-and-game industry, Reiss was impressed by the feverish public response north of the border to the 1980 Canadian board game, Trivial Pursuit, which was only just then being introduced in America. Reiss realized that other sorts of trivia games could be big sellers, too. With no introduction or insider connections—in what Reiss calls “a six-sentence cold-call letter that led to a $3 million profit venture in eight months”—he proposed a trivia game about television’s shows, history, and personalities to the publisher of TV Guide magazine.

TV Guide liked Reiss’s idea, and with the magazine providing the game’s content (questions and answers), Reiss began deftly negotiating licensing and royalty agreements. One key move involved persuading TV Guide, in exchange for increased royalties from additional sales, to carry free ads for stores that would sell the game. Drawing on his trusted contacts in the game industry and beyond, Reiss scrambled to assemble resources beyond his current control to pull the project together. He successfully raced to get TV Guide‘s TV Game distributed to both high-end and discount retailers (priced accordingly) in time for Christmas 1984—and just ahead of market saturation and flagging demand for trivia games. The total cost of designing and launching the TV Game was $50,000; revenues were $7.3 million.

All this and more is detailed in a 1985 HBS case study, “R&R”—the name of Reiss’s company—which was supervised by Professor Howard Stevenson (and prepared by Research Assistant José-Carlos Jarillo Mossi). “The R&R case is all about building a venture via bootstrapping and a little cash,” explains Reiss. “I think it’s remained relevant over the years because it’s a simple, compelling story that shows, if you are nimble and creative, how risk can be mitigated and that necessary resources can be accessed through partnerships, collaborations, and sharing pieces of the pie.” Moving quickly in a short-opportunity window is another lesson of the case, says Reiss, who also cites the critical importance of the sales function, something seldom taught at business schools, he notes.

The case is still taught today at HBS and more than 100 schools around the world, including some 40 percent outside the United States. Now in its 28th year, “R&R” is part of Harvard Business Publishing’s Premier Case Collection, which includes cases that are nominated by HBS faculty because they are popular and/or eminently teachable—and therefore often among HBP’s all-time best-sellers. The case played another important role as well. In the early 1980s, Reiss had read about Professor Howard Stevenson’s efforts, at Dean John McArthur’s behest, to figure out what academic approach HBS should take toward the still-nebulous (and slightly suspect at that point) concept and practice known as entrepreneurship. Reiss phoned Stevenson and arranged a visit. The two men discussed the R&R deal, which Reiss was then winding up, and Stevenson asked Reiss if he could write a case about it.

Notes Stevenson, “Bob helped me articulate the fact that entrepreneurship is not risk-taking. He put together a world of people where everybody did what they did naturally. In fact, taking on Bob’s risk actually diversified, and therefore lowered, risk for the others. Bob stood in the middle and orchestrated something and made a lot of money without anybody taking dangerous risks.” The case was a breakthrough for Stevenson and helped him formulate his now-famous discipline-defining description of entrepreneurship as “the pursuit of opportunity beyond resources currently controlled.”

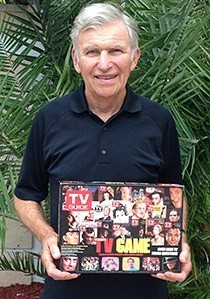

After a career during which he founded 16 companies, Reiss now resides in Delray Beach, Florida, as a self-described “KR” person—kind of retired, that is—who keeps busy writing and blogging (https://bootstrapping101.com/), when he’s not making “R&R” guest appearances in classrooms around the world.

As it happens, it was the case method that drew Reiss to HBS. It’s “where I really got into learning,” he says, citing Professor Milt Brown’s marketing course as especially enjoyable. So it’s only fitting that Reiss himself would become a protagonist of case studies: he’s also featured in a second HBS case, about Valdawn, a watch company he started. Indeed, some 30 years after the day Reiss first dropped in on Howard Stevenson, his “living example” has become a textbook case, a classic account of entrepreneurship in action.

The appendix of Bootstrapping 101 includes the R&R HBS case, mentioned in this article, along with an analysis of how the Bootstrapping tips advocated in the book were employed in the case.